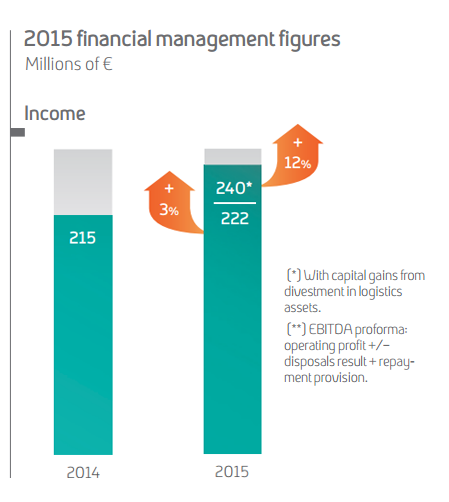

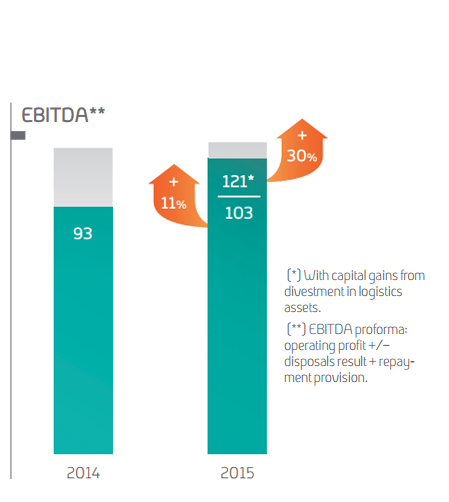

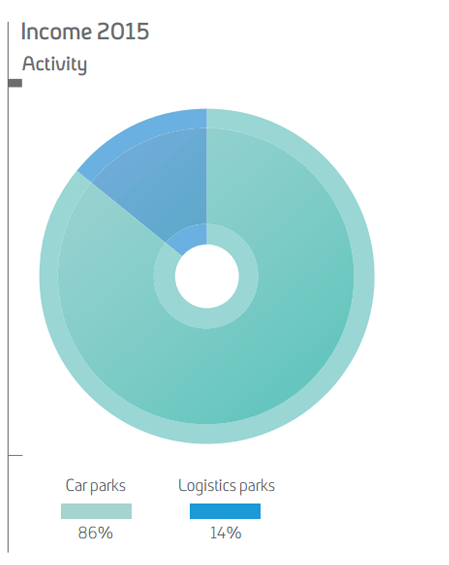

At the end of 2015, operating income from Saba's assets under management stands at 240 million euros, while EBITDA totalled 121 million euros. Excluding the impact of divestments in logistics parks, net income reached 222 million and EBITDA was 103 million, translating into a 46% margin, which has increasingly evolved in recent years despite a drop in business, mainly thanks to the implementation of improvement and efficiency measures, and new development operations.

The traditional policy of selective growth, based on profitability criteria and economic and legal certainty, as well as actions aimed at efficiently managing operations and technological innovation are the hallmarks of Saba, more so than ever before. As signs of economic recovery are confirmed and translated into growing consumption levels, efficiency activities and measures shall be the driving force to improve profitability. Saba invested €48 million in 2015, 68% to expand the network, the acquisition of CPE being the most significant.

Acquisition of CPE and divestment in logistics parks

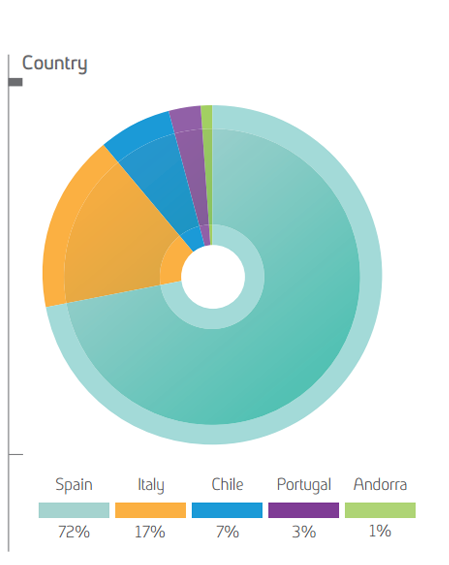

Together with strengthening the basic lines of the company's activity (efficiency, innovation and commercial proactivity), 2015 was characterised by a change in scope, thanks to being the winning bidder of Adif and Bamsa contracts in 2014, and the purchase of the Portuguese car park company CPE.

The 100% acquisition of CPE, with an investment of €25.3 million, is a very significant quantitative and qualitative step in the strategic positioning of the company in Portugal. It represents extending the average concession life of Saba in Portugal to 19.7 years, while doubling EBITDA figures at the same time, thanks to incorporating 19 car parks and 9,873 parking spaces.

Moreover, in terms of logistics parks, in 2015 Saba formalised the sale of the logistics park in Toulouse and a 32% stake in Cilsa, a concession company in the Logistics Activities Area of the Port of Barcelona. The operation is part of Saba's strategic plan to reorganise its asset portfolio and, at the same time, to grow in terms of car park activity, also enabling the Group to optimise its cash position.